EveryDollar Budget App

EveryDollar is the budgeting app that helps you find more margin and put it to work to beat debt and build wealth.

You May Also Like

If a few extra bucks of breathing room feels good, imagine finding thousands. With the EveryDollar app, you’ll uncover margin you didn’t know you had and make real progress on your money goals fast.

It’s the only budgeting app built on Dave Ramsey’s proven plan, and it’s already helped millions pay off debt and build lasting wealth.

Start for free in the App Store or Google Play.

Tell us about you and get personalized action steps that free up $3,015 on average.

You’ll feel like you got a raise!

Just. Like. That.

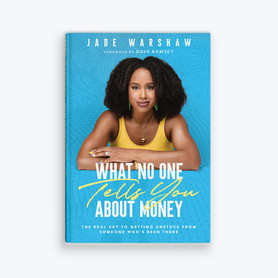

Fast, Simple, Easy Budgeting

Give every dollar a job and know where your money’s going:

- Create unlimited monthly budgets.

- Customize your budget how you want.

- Automatically stream transactions from your bank.

- Stay on top of your spending in seconds.

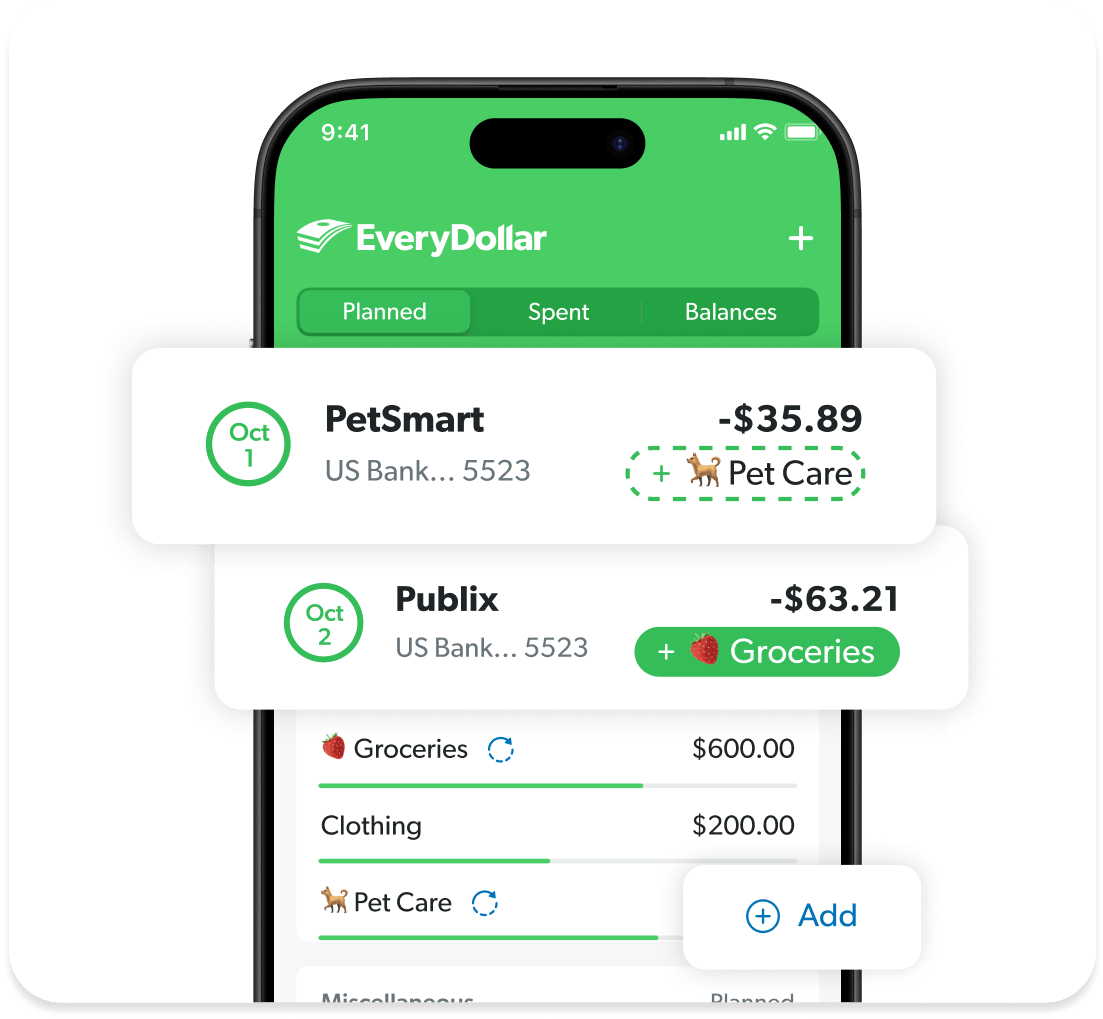

Progress Tracking

See your progress and stay motivated as you pay off debt and build wealth:

- Earn streaks for good money habits.

- Track your net worth and your millionaire date.

- See your full financial picture.

- Know when you’ll hit your big money milestones.

Money Coaching

Stay on track and get the support you need with digital, one-on one, and group coaching:

- Get personalized action steps to free up margin.

- Do bite-sized lessons to build better money habits.

- Join live workshops on budgeting and other topics.

- Get support from expert coaches (real humans, not bots).

From budgeting to building wealth, with EveryDollar, you’ll always know the right next step to take with your money.